The Case of a Bold & Beautiful Mutual Fund

KIRAN KUMAR K V

New Age (Non-UTI private sector) Mutual Fund

industry in India is more than 25 years old. The industry is generally measured

in the growth in its AUM. AUM of mutual

funds industry in India has grown from a meagre INR 65 Crores to INR 841300

Crores in the last 25 years. When the business propositions or market

presentations of the fund houses are analysed over this period, we can deduce –

(1) that mutual funds primarily

relied on the past performance against the benchmark as the key selling point; (2) that NFOs (New Fund Offers) were

promoted aggressively to increase share of wallet of retail investors with each

fund house; (3) that theme-based

funds were launched and promoted with attractive storylines; and (4) that corporate and individual agents

were heavily trained and incentivised to push specific funds. Other than these

the other routes used to promote mutual funds were through investor education

series and seminars, whitelisting of

funds through personal finance magazines & websites and of course, digital

presence through social media.

industry in India is more than 25 years old. The industry is generally measured

in the growth in its AUM. AUM of mutual

funds industry in India has grown from a meagre INR 65 Crores to INR 841300

Crores in the last 25 years. When the business propositions or market

presentations of the fund houses are analysed over this period, we can deduce –

(1) that mutual funds primarily

relied on the past performance against the benchmark as the key selling point; (2) that NFOs (New Fund Offers) were

promoted aggressively to increase share of wallet of retail investors with each

fund house; (3) that theme-based

funds were launched and promoted with attractive storylines; and (4) that corporate and individual agents

were heavily trained and incentivised to push specific funds. Other than these

the other routes used to promote mutual funds were through investor education

series and seminars, whitelisting of

funds through personal finance magazines & websites and of course, digital

presence through social media.

A noteworthy observation in the marketing efforts

of fund houses as above is that almost every fund house had the same approach.

There was no singular fund house that disrupted the flow and attempted a differentiator.

May be it was due to the fact that mutual funds were meant to be diversified

and hence, from no individual investor a fund house could expect 100% of his

allocation to the latter. Given such an ecosystem, what approach can give a new

entrant into the industry a kick-start? Does it really pay to focus on

traditional marketing model of ‘segmenting, targeting & positioning’? Can

there be a disruptive strategy one could adapt at this juncture, when there are

more than 40 active fund houses in the market offering more than 2000 mutual

fund schemes? It is in this context, this article aims to present the case of a

new fund house PPFAS Mutual Fund

that entered the industry in 2011 and launched their first and only fund – PPFAS

Long Term Value Fund in 2013.

of fund houses as above is that almost every fund house had the same approach.

There was no singular fund house that disrupted the flow and attempted a differentiator.

May be it was due to the fact that mutual funds were meant to be diversified

and hence, from no individual investor a fund house could expect 100% of his

allocation to the latter. Given such an ecosystem, what approach can give a new

entrant into the industry a kick-start? Does it really pay to focus on

traditional marketing model of ‘segmenting, targeting & positioning’? Can

there be a disruptive strategy one could adapt at this juncture, when there are

more than 40 active fund houses in the market offering more than 2000 mutual

fund schemes? It is in this context, this article aims to present the case of a

new fund house PPFAS Mutual Fund

that entered the industry in 2011 and launched their first and only fund – PPFAS

Long Term Value Fund in 2013.

Background:

Promoted by the Parag Parikh family (who have been

running a boutique investment advisory firm since 1992, targeting primarily the

HNWI investors) PPFAS Mutual Fund claims its mission is ‘to help clients achieve their long-term financial goals through prudent

fund management’. The fund is run by the fund management team comprising of

three managers, each looking after one segment of investing – equity, debt and

foreign equity. The AUM of the fund is

close to touching INR 600 Crores as on Feb 2016, while NAV has grown to INR

15.65 between May-2013 to Feb-2016. The fund’s sectoral exposure is skewed

towards Internet & Technology, Banks and Auto Ancillaries. The fund has

generated a CAGR of 17% since its inception. The fund claims to invest based on

value-investing philosophy following a bottom-up approach, i.e., to focus on

individual stocks instead of funnelling down from the macro-economic

indicators. In addition to regular opportunistic investing, fund also attempts

to make money through certain arbitrage opportunities in the market. Exposure to foreign equities through overseas securities, IDRs

and ADRs is an ad-valorem feature of

the fund.

running a boutique investment advisory firm since 1992, targeting primarily the

HNWI investors) PPFAS Mutual Fund claims its mission is ‘to help clients achieve their long-term financial goals through prudent

fund management’. The fund is run by the fund management team comprising of

three managers, each looking after one segment of investing – equity, debt and

foreign equity. The AUM of the fund is

close to touching INR 600 Crores as on Feb 2016, while NAV has grown to INR

15.65 between May-2013 to Feb-2016. The fund’s sectoral exposure is skewed

towards Internet & Technology, Banks and Auto Ancillaries. The fund has

generated a CAGR of 17% since its inception. The fund claims to invest based on

value-investing philosophy following a bottom-up approach, i.e., to focus on

individual stocks instead of funnelling down from the macro-economic

indicators. In addition to regular opportunistic investing, fund also attempts

to make money through certain arbitrage opportunities in the market. Exposure to foreign equities through overseas securities, IDRs

and ADRs is an ad-valorem feature of

the fund.

Differentiating:

Whether

it’s a conscious strategy or an internalised philosophy, the fund house

glaringly differentiates itself from its peers through its ‘prudent’ approach in managing the fund. And even with a little

research into the fund’s factsheet and the website, one can see that there does

exist a differentiated approach

to everything about this company.

it’s a conscious strategy or an internalised philosophy, the fund house

glaringly differentiates itself from its peers through its ‘prudent’ approach in managing the fund. And even with a little

research into the fund’s factsheet and the website, one can see that there does

exist a differentiated approach

to everything about this company.

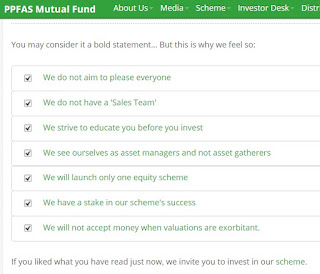

Being bold enough to communicate

what’s rational: A snap from the company’s

website in figure below gives the summary of all its differentiating factors.

The very aspect that, monotony of communication by a typical mutual fund is

broken, in itself establishes this brand at a different level.

“We do not aim to please everyone”: The fund managers say – “Our investment choices are not dictated by

glamourous factors, such as momentum, technical analysis, algorithms etc. We

prefer to stick to age-old metrics like cash flow, low debt etc., while

constructing the portfolio. This is our circle of

competence and we will never

stay too far from it.” Any security analyst would agree that what works for

stock in the long-run is its intrinsic parameters and operational performance

and the temporal trends, (aka momentum) are meant for speculators.

“We do not have a ‘Sales Team’”: Following a

relationship manager approach, rather than a sales approach and suggesting that

an investor’s subscription to the fund is the just the beginning of there RMs’

job and not the end, is in itself is a differentiator. Usually, mutual fund

houses will have business development executives, who would go all out to meet

various IFAs, and corporate agents to push for their fund. In this case, PPFAS

stands a little apart. This is also beneficial to the fund house in two other

ways: One, it ensures a long-term loyalty of the investor with the fund house;

Two, this increases the share of wallet of the investor with the fund house.

“We strive to educate you before you invest”: Investor

education initiatives by mutual fund houses so far, have generally been made at

a mass level, and in a way to generate an inroad into the investors’ places.

Whereas, dedicated investor education before every client signs up, is clearly

the most rational thing to do. This establishes a common understanding between

the investors’ expectations and fund’s deliverables. This is the most important

trait for any mutual fund, to avoid redemptions during bear runs (panic selling) and thus hurting even

those who wish to stay.

“We

see ourselves as asset managers and not asset gatherers”:

A direct hit on aggressive promotion of mutual

funds by other fund houses through heavily incentivized agency model, PPFAS

clearly claims increase in AUM through performance of the invested corpus,

instead of increasing the corpus size by fresh inflow.

“We will launch only one equity scheme”: Whereas fund houses generally have 50 funds (on

an average) spread across different themes, PPFAS dares to have only one fund

and keeps the liberty to allocate between different asset classes, themes and

investing styles within the fund. That is advantageous for the investor as he

need not worry about the asset allocation.

“We have a stake in our scheme’s success”: Inspired by the Hammurabi Code, close to 13% of the

fund’s AUM is held by ”Insiders” (Sponsor Company, Directors, Key Employees and

other stakeholders). This “SKIN IN THE

GAME” strategy is bound to gain the confidence of investors in a sweep.

This can turn out to be the USP of the fund, as no other fund house has known

to have followed such an approach.

“We will not accept money when valuations are exorbitant”: Rationality states that if there is no

opportunity in the market, there is no point accepting fresh inflows into the

fund. Accepting lump-sum investments during such times and keeping them in

cash, would disadvantage the existing investors’ corpus. There were fund

managers like Kenneth Andrade of IDFC Mutual Fund, who use to subtly follow

this mechanism, keeping this as a policy framework is a great take-home for the

investor.

Unitholders’

Meet: Conducting an AGM

of unitholders’ creates a kind of confidence in investors. The fact that fund

management team meets the investor in itself is a great comfort for a layman

investor. This also gives a feeling that fund management team is proactive in

its communication and accountable in its execution.

‘Tortoise’ as a Brand

Element: The brand logo contains a

tortoise as an element. It is meant to signify longevity, timing, and

timelessness of investment principles.

In conclusion, PPFAS may be

just a mutual fund, not too differentiated in its product. But, it’s for sure

differentiates itself with its value-driven rationalist philosophy. With

increased visibility and consistent delivery of promises, as above, PPFAS can

be a trendsetter in the mutual fund industry. The case of PPFAS will be a treat

for an academician, as it emphasizes the substance

over style.

just a mutual fund, not too differentiated in its product. But, it’s for sure

differentiates itself with its value-driven rationalist philosophy. With

increased visibility and consistent delivery of promises, as above, PPFAS can

be a trendsetter in the mutual fund industry. The case of PPFAS will be a treat

for an academician, as it emphasizes the substance

over style.

Bibliography

KPMG.

(2014). Indian Mutual Fund Industry: Distribution Continuum: Key to

Success. KPMG and CII.

(2014). Indian Mutual Fund Industry: Distribution Continuum: Key to

Success. KPMG and CII.

Kumar,

K. K., & Rakesh, H. (2015). Do Fund Characteristics Determine Fund

Performance? Empirical Evidence from Indian Equity Mutual Funds. International

Journal in Management and Social Science, 3(1), 250-264.

K. K., & Rakesh, H. (2015). Do Fund Characteristics Determine Fund

Performance? Empirical Evidence from Indian Equity Mutual Funds. International

Journal in Management and Social Science, 3(1), 250-264.

We

Are Different. (2016, March 15). Retrieved from PPFAS Mutual Fund:

http://www.amc.ppfas.com/

Are Different. (2016, March 15). Retrieved from PPFAS Mutual Fund:

http://www.amc.ppfas.com/