The Case of a Bold & Beautiful Mutual Fund

KIRAN KUMAR K V

New Age (Non-UTI private sector) Mutual Fund industry in India is more than 25 years old. The industry is generally measured in the growth in its AUM. AUM of mutual funds industry in India has grown from a meagre INR 65 Crores to INR 841300 Crores in the last 25 years. When the business propositions or market presentations of the fund houses are analysed over this period, we can deduce – (1) that mutual funds primarily relied on the past performance against the benchmark as the key selling point; (2) that NFOs (New Fund Offers) were promoted aggressively to increase share of wallet of retail investors with each fund house; (3) that theme-based funds were launched and promoted with attractive storylines; and (4) that corporate and individual agents were heavily trained and incentivised to push specific funds. Other than these the other routes used to promote mutual funds were through investor education series and seminars, whitelisting of funds through personal finance magazines & websites and of course, digital presence through social media.

A noteworthy observation in the marketing efforts of fund houses as above is that almost every fund house had the same approach. There was no singular fund house that disrupted the flow and attempted a differentiator. May be it was due to the fact that mutual funds were meant to be diversified and hence, from no individual investor a fund house could expect 100% of his allocation to the latter. Given such an ecosystem, what approach can give a new entrant into the industry a kick-start? Does it really pay to focus on traditional marketing model of ‘segmenting, targeting & positioning’? Can there be a disruptive strategy one could adapt at this juncture, when there are more than 40 active fund houses in the market offering more than 2000 mutual fund schemes? It is in this context, this article aims to present the case of a new fund house PPFAS Mutual Fundthat entered the industry in 2011 and launched their first and only fund – PPFAS Long Term Value Fund in 2013.

Background:

Differentiating:

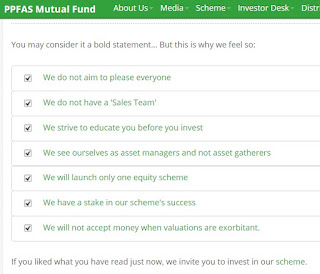

Whether it’s a conscious strategy or an internalised philosophy, the fund house glaringly differentiates itself from its peers through its ‘prudent’ approach in managing the fund. And even with a little research into the fund’s factsheet and the website, one can see that there does exist a differentiated approach to everything about this company.

competence and we will never stay too far from it.” Any security analyst would agree that what works for stock in the long-run is its intrinsic parameters and operational performance and the temporal trends, (aka momentum) are meant for speculators.

‘Sales Team’”: Following a relationship manager approach, rather than a sales approach and suggesting that an investor’s subscription to the fund is the just the beginning of there RMs’ job and not the end, is in itself is a differentiator. Usually, mutual fund houses will have business development executives, who would go all out to meet various IFAs, and corporate agents to push for their fund. In this case, PPFAS stands a little apart. This is also beneficial to the fund house in two other ways: One, it ensures a long-term loyalty of the investor with the fund house; Two, this increases the share of wallet of the investor with the fund house.

A direct hit on aggressive promotion of mutual funds by other fund houses through heavily incentivized agency model, PPFAS clearly claims increase in AUM through performance of the invested corpus, instead of increasing the corpus size by fresh inflow.

e a stake in our scheme’s success”: Inspired by the Hammurabi Code, close to 13% of the fund’s AUM is held by ”Insiders” (Sponsor Company, Directors, Key Employees and other stakeholders). This “SKIN IN THE GAME” strategy is bound to gain the confidence of investors in a sweep. This can turn out to be the USP of the fund, as no other fund house has known to have followed such an approach.

In conclusion, PPFAS may be just a mutual fund, not too differentiated in its product. But, it’s for sure differentiates itself with its value-driven rationalist philosophy. With increased visibility and consistent delivery of promises, as above, PPFAS can be a trendsetter in the mutual fund industry. The case of PPFAS will be a treat for an academician, as it emphasizes the substance over style.

Bibliography

KPMG. (2014). Indian Mutual Fund Industry: Distribution Continuum: Key to Success. KPMG and CII.

Kumar, K. K., & Rakesh, H. (2015). Do Fund Characteristics Determine Fund Performance? Empirical Evidence from Indian Equity Mutual Funds. International Journal in Management and Social Science, 3(1), 250-264.

We Are Different. (2016, March 15). Retrieved from PPFAS Mutual Fund: http://www.amc.ppfas.com/