MEASURING FINANCIAL LITERACY: CONCEPTUAL STUDY

Sudindra V R

1. INTRODUCTION:

Unlike traditional roles played by governments and employers in managing investments on behalf of individual significantly transformed in recent past due to change in social structure across the world. It is responsibility of individuals in managing their own finance to secure their financial future. In the complex financial environment, it is imperative that individuals develop nuanced understanding of world of finance to meet their financial goals and needs. It is observed that most of the individuals under-saved, fail to invest wisely and continued to be overburdened with loans/advances.

2. CONCEPT OF FINANCIAL LITERACY:

OECD- Organization of Economic Co-operation and Development, defines financial literacy is a combination of awareness, knowledge, skills , attitude and behaviors necessary to make sound financial decisions and ultimately achieve individual financial wellbeing.

3. COMPONENTS OF MEASURING FINANCIAL LITERACY:

Measuring financial literacy requires a clear understanding of financial literacy concepts and application of appropriate evaluation tools.

Major components of financial literacy includes:

Ø Savings/borrowings: basic understanding of savings alternatives, different types of savings account, borrowing procedures, debt literacy and ability to plan for future.

Ø Personal budgeting:understanding of personal budgeting, budget balance, taxation impact on income, disposable income and estimation using appropriate measures.

Ø Economic issues:understanding of economic situation, economic ratio’s, knowledge of economic terms and etc.

Ø Financial concepts:understanding of time value of money, risk and returns, risk profiling, timing in investments and other related concepts.

Ø Financial services:knowledge of financial products, services, mechanism of card services, insurance, broking services, online services and other financial services.

Ø Investing:understanding of investment opportunities, risk and rewards and other investment related risks.

4. OECD FINANCIAL LITERACY MEASUREMENT DEVELOPMENT PROCESS:

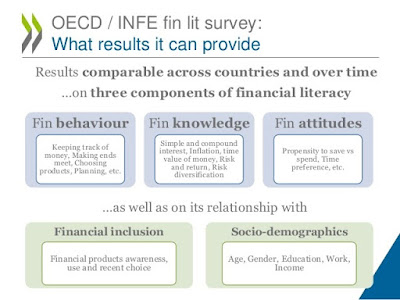

Based on 18 existing survey from 16 countries, OECD developed international good practice in financial literacy measurement. With support and guidance from expert sub group developed survey instrument (questionnaire), which covers attitude and knowledge as well as capturing behavior related topics like money management, planning, financial/investment goals and awareness of financial product & financial services.

Measurement instrument must achieves the following objectives:

Ø Questionnaire must be based on widely accepted definition of financial literacy which emphasis general behavior, attitude and knowledge.

Ø All the components of financial literacy must be able to identify the relationship with financial product awareness, use and recent choices and socio demographic: age, gender, education, work and income variables.

Ø It should be read loud by an interviewer and consists of Likert type scales.

Ø It should be market specific questions: such as product awareness, access to information about the product and comparable to international data.

Ø It should stress on individual capacity to draw on savings is relative rather than absolute. Focused on amount of time they could manage for, rather than the amount of money they have saved.

Ø Sequential approach to review product awareness to ensure respondents not made to feel financially excluded.

5. CONCLUSION:

Traditionally government use to play vital role in managing investment of individuals but in today’s complex environment, individuals has to manage their own finance their future financial goals and needs. It is observed that most of individuals are under-saved, fail to invest wisely and indebtedness. To understand level of financial literacy majorly savings/borrowing, personal budge, economic issue, financial concepts, financial service, financial product and investment components can be consider. OECD developed the instrument based on existing survey which considered widely accepted definition, market specific questions, focused rather than absolute and sequential review of product awareness.

<https://www.oecd.org/finance/financial-education/49319977.pdf>