KIRAN KUMAR K V, Faculty – Finance, ISME

The year gone by – 2018

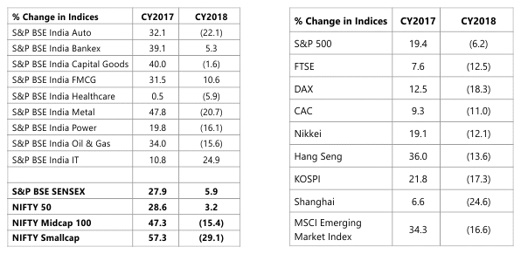

World Markets

In terms of global growth and inflation, 2018 has been a year of transpiration. The comparable balanced global economic condition of 2017, lost the synchrony in 2018 – The rampant growth trend of US markets was seen to be coupled with slowed down growth of European region. We also saw a more stable flow of Chinese economy, and a mixed growth trend in other Asian and emerging market regions. One can dedicate these to more of country-specific factors than for an influence of global trend. Few factors that one can enumerate can be:

- Political changes in advanced economies including Euro region, UK (Brexit), midterm elections in US, state elections in India and leadership shift in Brazil

- Monetary tightening by US Fed

- Global trade-war concerns , including re-imposition of sanctions by US on Iran

- Turmoil in Italy

- Protectionist policies adopted by major economies on international trade front

- IMF reducing the global growth rate projections from 3.7% in 2018 to 0.2% for 2019

The impact of above, could be seen on global equities, during the end of 2018. Especially, global trade dependent economies, including China, Europe and Asian were the worst hit. Brent crude prices also fell during 2018, with the looming concerns over slower than expected growth rate of global economy, as well as rising inventory. Metals remained weak. As an indication, as always had been, gold strengthened, a signal of investor base looking for a safer diversification option.

Indian Markets

Clubbed with international trends, certain domestic factors, few serious ones had the Indian markets play on its toes during 2018. From the investors’ fortunes account perspective, one could see euphoria during some seasons of the year, and one could also smell despair at times.

There were factors listed below, few positive, few negative, that could be attributed to an volatile trend of Indian equities:

- Positive macroeconomic data, for most part of the year

- Encouraging corporate earnings announcements

- Introduction of long term capital gains tax

- State election results

- NBFC liquidity concerns

- Rate hikes by RBI to contain increased inflation and the volatility in G Sec yields due to fluctuating oil prices and FII flows

- Change of guard at RBI

- Strengthening and implementation of Insolvency and Bankruptcy code

- Rupee depreciation

- India’s ranking in ease of doing business moving up 23 levels

- Rationalisation of GST rates on various goods

- Merger of banks

As a result of above and multiple other events during the year, equity indices touched new highs, domestic institutional investments increased by more than Rs. 185bn in 2018 (as compared to 2017).

The year to look forward – 2019

Global Trends to look Forward

Led by global de-growth, especially from US and some Asian economies, outlook for 2019 seems to be positive, yet moderate. US earnings and the broader global economic growth may moderate, especially due to the fact that the previous rally led by significant tax cuts by US to provide fiscal stimulus and increased public spending plans, are going to diminish. There is an expected increase in sentiment towards emerging markets, as can be seen from foreign portfolio investors shifting focus.

Domestic Trends to look Forward

India, in the middle of emerging markets arena, is poised to attract foreign flows. India continues to enjoy the strong fundamentals coupled with moderating valuations and continue the path of sustainable growth. Political stability is expected to be a key factor that’s going to affect the way 2019 gets shaped for Indian equities. State elections and general elections upcoming in few months, have gifted the highest possible volatility to Indian markets. Add to these the competitive political policy promises like loan waivers, unemployment allowances, subsidies, GST reduction and the likes are not so positive news for certain related sectors. Being the populist measures, most of these may boost the rural consumption, but, would they be able to account over and above the cost of funds for infrastructural projects. Inflation is also expected to touch high levels as an after-effect of most of these policy measures. If these things gets coupled with reduction in investor confidence in domestic markets, and thus the capital flows from DII comes down, the age-old lacunae of Indian markets having dependency on foreign portfolio flows won’t be good sign.

It can also be not denied that the policy reform measures taken by the present government to improve the productivity – GST, Insolvency and Bankruptcy Code, JAM (Jan-dhan, Aadhaar, Mobile) trinity, ease of doing business, bank recapitalization, increasing FDI limits across sectors, are expected to have positive impact on the economy. Domestic banking sector is also expected to drive a higher credit growth in 2019, which will work in direction of improving higher domestic consumption. Manufacturing sector, thus, may focus on higher capacity utilization and also increase corporate capex.

Summary Outlook

In conclusion, 2019 seems to be a year of stabilization for Indian equities, especially, in the second half, with a hope of political stability and global growth moderation. We can point out the below expectation in Indian markets:

–

- Most economic indicators like credit growth, PMI, IIP, capacity utilization, traffic (goods & passenger) growth, cement production may be healthy and show a stable trend

- Momentum of capex in roads, housing, railways, power etc are likely to continue

- Private capex is expected to increase

- Economy may move towards more formalization due to GST rationalization & emerging clarity

- Banking may better perform due to NPA and provisioning costs, credit growth, increased corporate capex, recapitalization to PSU banks

Disclaimer: The views, opinions and content on this blog are solely those of the authors. ISME does not take responsibility of content which are plagiarized or not quoted