Dec 16, 2021.

A recent article spoke about Choice Paralysis among buyers, which essentially leaves a not-so-satisfying taste post-purchase of a product. Simply because, seller presents an unnecessarily wider assortment of product to the buyer, and buyer, unsure of the best way to choose, will end up making a sub-optimal buying decision. In the Indian consumer market, the health insurance products have been constantly seeing a surge in demand especially post-pandemic. And basic research into websites, aggregators and mobile apps of health insurance industry would leave a layman consumer with seemingly homogeneous, but inherently heterogenous range of health insurance products. A case for Choice Paralysis indeed.

The objective of this article is to simplify various categories of health insurance schemes currently available and if possible, make an attempt give a simplified framework to select the right health insurance scheme.

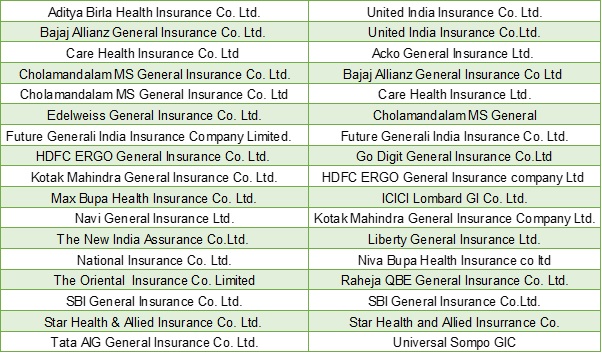

First, let us list down the companies that are offering health insurance schemes in India. Note that these are companies that are actively advertising their products in public domain and are approved by IRDA[1] to offer health insurance products in India, as well as they have an assortment of health insurance related schemes on offer:

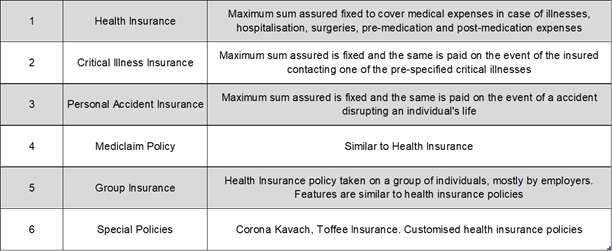

Second, let us make a list of different types of health insurance plans. One challenge here is that there is no one standard nomenclature given by the regulator nor is the product developers attempt to standardise the offering. This has led to a heterogeneous assortment of health insurance schemes offered by companies. Yet, an attempt is made to group the products based on the primary nature of the product and briefed below:

[1]https://www.irdai.gov.in/ADMINCMS/cms/NormalData_Layout.aspx?page=PageNo4544&mid=27.3.9

Third, let us list down few pressing questions related to buying a health insurance policy that you need to decide and also try to answer them:

- Do I need to cover self (individual) or family? If it is family, is it only the spouse and kid/s or both parents to be covered?

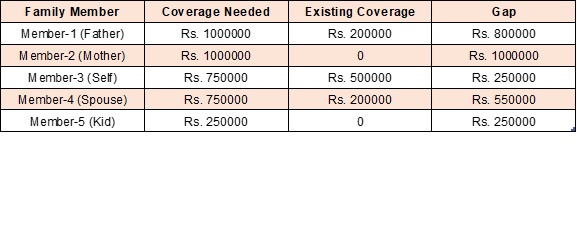

Answer: “Depends. The thumb rule is that every family member should be covered under a health insurance scheme for sure. Having said that, the amount of coverage for each member would depend on a subjective estimate of health hazard, which in turn, depends on the age, health history and overall exposures. And if each member has to be covered and let’s say, husband and wife both are working and they both have taken separate insurance, the same needs to be discounted while taking health covers. To make it simple, use the below framework:

Based on the gap, you can choose to cover each individual. Remember two things: One, every rupee of sum assured, will increase your premium. Two, it is possible that the cost of convenience of taking a single policy for the entire family, might be a suboptimal decision.”

- I already have a coverage through a group health scheme from my employer. Should I still buy one on my own?

Answer: “There are three aspects you should get clarity on before working on this: ONE: What exactly are the coverage terms and conditions in your employer’s policy? It might so happen that your employer has taken the policy mostly to meet a regulatory requirement and might have chosen a policy that worked out cheaper with compromises made in terms of maximum amount of reimbursement for bed cost per day or pre and post-medication expenses or even the coverage of hospitals. Take for instance, the employer given policy might be for reimbursing only upto Rs. 1000 per day bed charge or even lesser, which might restrict you to spend money out of your pocket too, as an average multi-specialty hospital in an urban area bed charge are minimum Rs. 2500 per day. Some group insurance policies do not cover maternity expenses. TWO: What happens to the coverage, if I quit from said employment? Most group policies do not reimburse, if you are not employed with that specific company at the time hospitalisation. THREE: What is the total coverage amount? Generally, employers will have a ceiling on the sum assured depending on the level of employment. Based on this and the Gap analysis as per point 1 above, you can go for additional policies. In a generic sense, the coverage by employer is seen to be lower than what might actually be needed.”

- Should I buy health insurance from one insurance provider or diversify across two or three?

Answer: “Availing multiple service providers will cause inconvenience. It will also be suboptimal for two reasons: One, the higher sum assured with one company will result in certain discounts in pricing and two, the ease of claiming reimbursement becomes much easier if it is one service provider. Few individuals attempt to diversify across insurance companies to bring down the risk of rejection of certain claims. But the claim settlement standards are common across insurance companies and IRDA regulations are also strong in this regard. Hence, there will be no need to go with multiple service providers.”

- Is there a need to look for health insurance products that cover the pre-existing diseases?

Answer: “This is a tricky dilemma. In a normal health insurance product, pre-existing diseases are not covered and there is a 180-day waiting period. Nowadays, many companies have started offering products that cover pre-existing diseases too. But, you must note that in case of pre-existing disease the premium will also increase accordingly and based on the preliminary underwriting, chances are that the policy may not be issued depending on the severity of the condition correctly. Its worthy here to mention that, insurance is a legal contract that is proposed by you and based on the declarations made by you the company is accepting your proposal. Unclear declarations about the pre-existing diseases will only put the family at inconvenience at the time of hospitalisation. While there is no straight answer to the question, but, coverage of pre-existing disease does not seem to be necessarily a gain tilted towards the policy holder.

- For what amount of sum assured should I take my policy?

Answer: “There are thumb rules. Some say it should be 50% of one’s annual income. Some also say, it should be the highest expense your family might have incurred in the recent past on a major health issue. A round amount of Rs. 5 lakhs are suggested by financial advisors in India for mid-income family. Instead, it may be better to do basic research for yourself, if possible, through some primary sources. What might it cost for a coronary art bypass graft in a hospital of your choice? Ensure to enquire about the overall cost and not just the surgery, that includes hospitalisation, pre and post medication and other allied expenses. This can be a starting point to decide a minimum amount of health cover. Note that this information needs to be updated every year, as cost of health expenses are raising too.”

- Should I pay extra to cover the lifestyle needs in case of critical illness or life-changing accidents?

Answer: “Securing lifestyle of the family in case of unforeseen demise or the permanent disability of the active earner or breadwinner of the family is a non-negotiable priority. Opting for a separate critical illness cover would depend on the amount of life insurance (sum assured) you have. This, in turn, would depend on the amount needed for the family/dependents to lead a similar standard of lifestyle, even after the absence of income from the insured person. What corpus amount would my family need in case of my permanent disability to earn and provide? Also, cautiously observe for certain critical illnesses, that have hereditary nature of imbibing, and thus, increase the probability of contacting. One thing is for sure, that the life insurance will cover the security need in case of death, whereas health insurance covers the expenses of treatment, but the need to survive in case of permanent disability is a risk that needs to be taken seriously. To answer simply, yes, you need critical illness or permanent disability cover too, additionally.”

Finally, in conclusion, the number of products available in the market are heterogeneous, difficult to choose, cost vs value can never be convincingly measured in case of these products and moreover, the products are themselves getting updated with more features, faster than mobile phones. While efforts can be made to choose a right product, and it may lead to choose-paralysis, one has to realise, it is a product that is a must-have for everyone, considering the changing healthcare conditions. With the pandemic environment experienced by all, and the literacy around the health insurance combined with more FinTech firms entering the industry, there are more sophistications that one can start seeing in this line. Till then, keep investing your wealth to buy health insurance plan, as there was no better time to reiterate the age-old adage – “Health is Wealth…!!”

References:

HDFC Ergo. (n.d.). Retrieved from https://www.hdfcergo.com/blog

IRDAI. (n.d.). Retrieved from https://www.irdai.gov.in/ADMINCMS/cms/whatsNew_Layout.aspx?page=PageNo4407&flag=1

Policy Bazaar. (n.d.). Retrieved from https://health.policybazaar.com/quotes?encenq=OUhiQTM3NWh0dC9qekU5MXovc01HQ1J0N1RFcnU5MFpTUVJxYXJYTGFRND0&enquiryid=MzU1Mzk4OTQx&pq=health0&profileid=73430880&utm_content=home_v10